Governance Corporate Governance

Governance of SHR

SHR's governing bodies consist of a general meeting of unitholders, a board of directors with at least an executive director and a supervisory director, and an accounting auditor.

The executive director oversees SHR's operations and, as SHR's representative, has the authority to act in and out of court with respect to any and all of SHR's affairs. The supervisory directors supervise the executive director's execution of duties. The Board of Directors is held at least once every three months and makes important decisions regarding SHR's operations, including approval of the execution of important duties by the executive directors and financial statements. The supervisory directors supervise the executive director's work by means of reports provided by the executive director on the status of the management of SHR's assets as needed and on investigations results and other tasks requested by the supervisory directors.

The accounting auditor audits SHR's financial statements and also serves legally mandated roles, such as reporting to the supervisory auditors in the event that, in its auditing process, it discovers an illegal action or serious violation of any law or regulation, or of SHR's Articles of Incorporation in connection with the executive director's execution of duties.

Executive Director and Supervisory Directors

This table can be scrolled sideways.

| Position | Name | Reasons for Appointment | Attendance Status | |

|---|---|---|---|---|

| FP ended Apr. 2023 (17th FP) | FP ended Oct. 2023 (18th FP) | |||

| Executive Director | Atsuhiro Kida | We have appointed him as the Executive Director because it is expected that he will be able to accurately execute operations of SHR, taking into account comprehensively his expertise in real estate, financial accounting and extensive experience in REIT operations. | 8 times/8 times (100%) |

8 times/8 times (100%) |

|

Supervisory Director (Note1) (Note2) |

Yu Yada | In addition to having his excellent character, insight, and ability, he is well versed in corporate management and other fields as an attorney-at-law. In light of his expertise and experience in each of these fields, we believe he is qualified to serve as a Supervisory Director of SHR, and have appointed him as a Supervisory Director. | 8 times/8 times (100%) |

8 times/8 times (100%) |

| Rei Yamashita | In addition to having her excellent character, insight, and ability, she is well versed in corporate management and other fields as a certified public accountant. In light of her expertise and experience in each of these fields, we believe she is qualified to serve as a Supervisory Director of SHR, and have appointed her as a Supervisory Director. | 8 times/8 times (100%) |

8 times/8 times (100%) |

|

| Ayako Sugiura | In addition to having her excellent character, insight, and ability, she has extensive expertise and experiences in real estate as a certified real estate appraiser. In light of her expertise and experience in each of these fields, we believe she is qualified to serve as a Supervisory Director of SHR, and have appointed her as a Supervisory Director. | - | - | |

(Note1)Supervisory Directors of SHR are independent officers who have no special interest with SHR based on Article 100 of the Act on Investment Trusts and Investment Corporations (Investment Trust Act) as well as Article 164 of the Regulation for Enforcement of the Act on Investment Trusts and Investment Corporations.

(Note2)Ayako Sugiura has been appointed as a new Supervisory Director since February 1, 2024.

Click here for biographies of current directors.

Promoting Diversity among Directors

Based on the belief that diversity is important to SHR, we promote diversity in the composition of directors. Since February 2024, the ratio of female directors has been 50.0%.

Restrictions on the Sale and Purchase of Investment Units, etc. by Directors

From the viewpoint of preventing insider trading, SHR’s “Insider Trading Management Regulation” prohibits Directors of SHR from buying and selling investment units or investment corporation bonds issued by SHR. Thus, none of our Executive Director or Supervisory Directors holds the investment units or investment corporation bonds of SHR.

Director's Remuneration

The upper limit of remunerations for executive directors and supervisory directors is stipulated in the Articles of Incorporation and the amount is determined at the Board of Directors (however, the upper limit per person is 1,000,000 yen per month for an executive director, and 500,000 yen per month for a supervisory director).

Directors' compensation is as follows.

This table can be scrolled sideways.

| Position | Name | Remuneration Amount (Thousand yen) | |

|---|---|---|---|

| FP ended Apr. 2023 (17th FP) |

FP ended Oct. 2023 (18th FP) |

||

| Executive Director | Atsuhiro Kida | - | - |

| Supervisory Director | Yu Yada | 1,800 | 1,800 |

| Rei Yamashita | 1,800 | 1,800 | |

Accounting Auditor

Accounting Auditor

This table can be scrolled sideways.

| Name | Continuous Audit Period |

|---|---|

| Ernst & Young ShinNihon LLC | From September 2014 until present |

Accounting Auditor's Compensation

The compensation for the accounting auditor is set by the Investment Corporation's Board of Directors at a maximum of 25 million yen for each fiscal period covered by the audit.

This table can be scrolled sideways.

| Accounting auditor | Compensation Details | Compensation Amount (Thousand yen) | |

|---|---|---|---|

| FP ended Apr. 2023 (17th FP) |

FP ended Oct. 2023 (18th FP) |

||

| Ernst & Young ShinNihon LLC | Compensation based on audit attestation services | 17,400 | 17,400 |

| Compensation for non-audit services | - | - | |

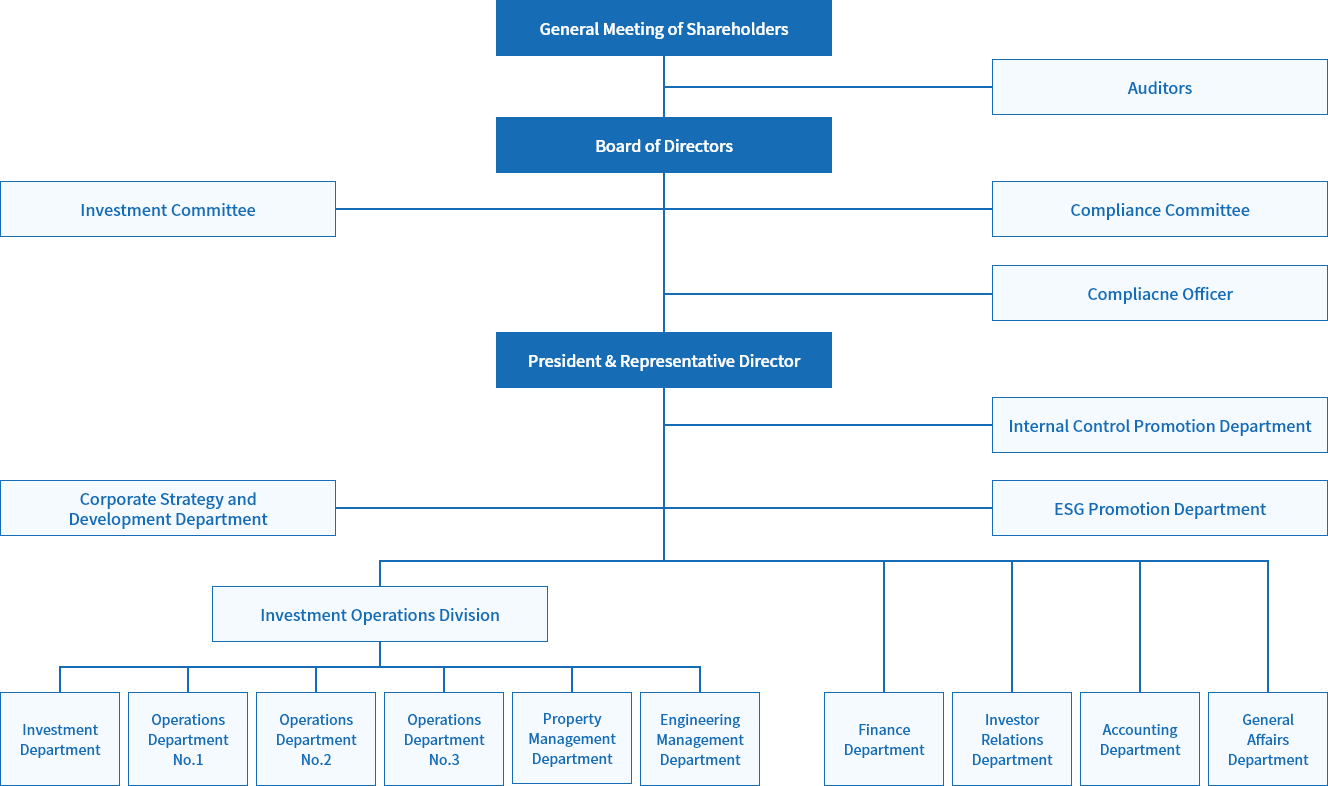

Organizational Structure

The organizational structure of SHAM, to which SHR entrusts the management of its assets, is as below.

Organization Chart of SHAM

< Overview of each organization >

This table can be scrolled sideways.

| Name | Overview |

|---|---|

| Board of Directors |

Composition

Frequency of Meetings

Requirements for Resolution

Resolutions In addition to matters stipulated in laws and regulations or the Articles of Incorporation, the Board of Directors decides the following matters;

|

| Investment Committee |

Composition

Committee Chairman: President & Representative Director Frequency of Meetings In principle, held at least once every three months, and as needed Holding/Resolution Requirements

Established with the attendance of a majority of members of the committee who can participate in voting Contents of Deliberation

|

| Compliance Committee |

Composition

Committee Chairman: Compliance Officer Frequency of Meetings In principle, held at least once every three months, and as needed Holding/Resolution Requirements

Established with the attendance of a majority of members of the committee who can participate in voting Contents of Deliberation

|

Asset Management Fee

Concerning the asset management fee paid by SHR to SHAM, the following management fee structure has been adopted from the viewpoint of emphasizing linkage with unitholder profits. Regarding the management fee ①, SHR introduced a mechanism of “fees linked to total assets and unit price performance”, in which the fee rate fluctuates by comparing the performance of the investment unit price of SHR with the performance of the Tokyo Stock Exchange REIT Index. Through this process, we are further strengthening the incentives to maximize the unitholder value of SHR by aligning the interests of SHAM and, consequently, Sekisui House, as a stockholder of SHAM, with the interests of unitholders of SHR.

This table can be scrolled sideways.

| Compensation Amount (Thousand yen) | ||

|---|---|---|

|

FP ended Apr. 2023 (17th FP) |

FP ended Oct. 2023 (18th FP) |

|

|

Management Fee ① Total assets x (0.14% (annual rate) + |

413,403 | 401,718 |

|

Management Fee ② (Distributable amount per unit (Note3) × |

529,778 | 671,509 |

|

Management Fee ③

Trading value related to the acquisition of |

660(Note8) | 1,470 |

|

Management Fee ④

Trading value related to the disposition of |

- | 24,300 |

|

Management Fee ⑤

Value of real estate-related assets held by |

- | - |

(Note1)With regard to rates, unless otherwise specified, applicable rates or expected rates are stated instead of maximum rates.

(Note2)The upper and lower limits of rates linked to the Tokyo Stock Exchange REIT Index performance are +0.02% and -0.02% respectively. The rate fluctuates depending on the performance of the investment unit price of SHR in comparison with the Tokyo Stock Exchange REIT Index.

(Note3)Calculated as the distributable amount before deduction of Management Fee ②divided by the total number of issued investment units.

(Note4)Operating Income of before deduction of Management Fee ②.

(Note5)As SHR implemented a 2-for-1 split of the investment units with May 1, 2018 as the effective date, Management Fee ② formula includes multiplication 2, which is the split ratio.

(Note6)The trading value does not include consumption tax, etc. and expenses, etc.

(Note7)In case of loss on disposition, the fee rate will be 0%.

(Note8)Amounts of the asset management fees related to the silent partnership equity interest are included in the book value.

Evaluation of the Effectiveness of SHR’s Board of Directors and SHAM’s Board of Directors

SHR and SHAM set "Enhancing the Effectiveness of SHR's Board of Directors and SHAM's Board of Directors" as well as "Conducting effectiveness evaluation questionnaire" as KPIs, and conducted self-evaluation. With this self-evaluation, we do not only confirm whether the respective Boards of Directors fulfill their roles responsibly, but also enhance the effectiveness of the respective Boards of Directors.

Effectiveness evaluation questionnaire is conducted once a year so that Executive Director, Supervisory Directors, Directors, and Auditors can identify issues and make improvements based on the self-evaluation.

In the previous questionnaire, SHR’s Board of Directors and SHAM’s Board of Directors confirmed that their effectiveness was sufficiently ensured in terms of member composition, frequency of meetings, number of agenda items, and the status of deliberation methods and discussions. On the other hand, it is recognized that strengthening the foundations for formulating management policies and facilitating the management of meetings are issues to be addressed.

We will continue to strive to improve the effectiveness of SHR’s Board of Directors and SHAM’s Board of Directors by responding sincerely to issues recognized from the results of the questionnaire.