DISTRIBUTIONS

- FP 18

Ended Oct. 2023 - 1,976yen

Start of payment:Jan. 23, 2024

- FP 19

Ending Apr. 2024 - 2,038yen

- FP 20

Ending Oct. 2024 - 1,732yen

PORTFOLIO DATA

- Number of

Owned Properties - 131properties

- Total

Acquisition Price - 551.6billion yen

- Occupancy Rate

- 97.1%

(as of Mar. 31, 2024)

- Residential Properties

- 97.2%

- Commercial Properties

- 96.8%

FINANCIAL STATEMENTS

FP 18 Ended Oct. 2023

- PDF Financial Report(1.3MB)

- PDF Presentation Material(3.4MB)

- PDF Script and Q&A

(Summary) of the Financial

Results Briefing(5.0MB) - PDF Semi-Annual Report(2.5MB)

- XLS DATABOOK(599KB)

TOPICS

SUSTAINABILITY

that leads the way into an era of the 100-year lifespan

PORTFOLIO

PORTFOLIO DEVELOPMENT POLICY

SHR positions and invests in residences, which form "the bases of living" for residents, and office buildings, which form "the basis of operation for businesses", as the core assets of portfolio, and considers investment in hotels with growth prospects; by doing so SHR will aim to build a portfolio characterized by both high stability and high quality.

Medium Term Target Investment Ratio

Medium Term Target Investment Ratio

- Residential

- Approximately 65%

- Office building

- Approximately 30%

- Hotel, Retail and other properties

- Approximately 5%

Investment Area by Asset Type

- Residential (Greater Tokyo)

- 70% or more

- Office building, Hotel, Retail, etc. (Three major metropolitan areas)

- 80% or more

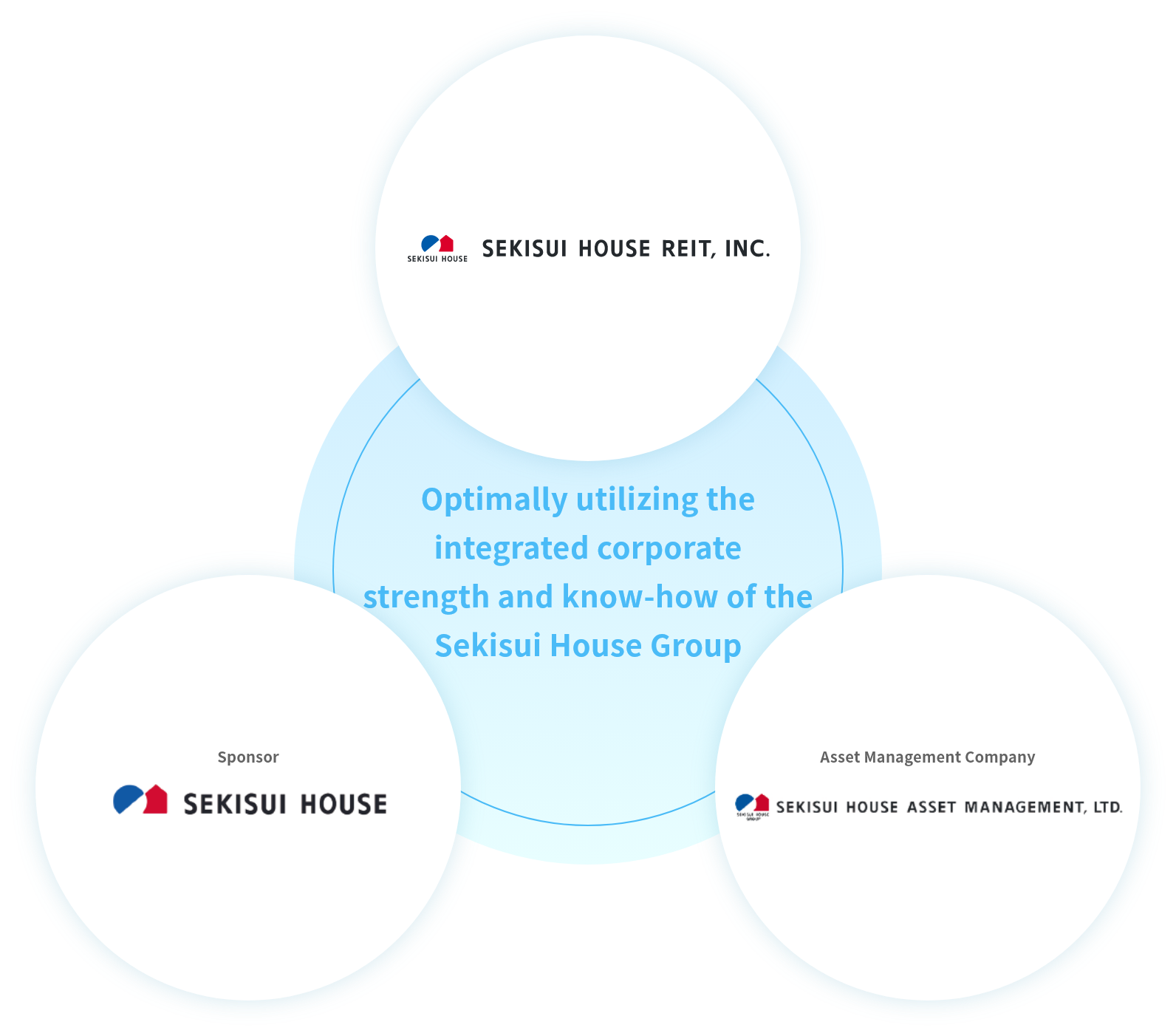

GROWTH STRATEGY

SHR aims to continuously increase unitholder value by expanding the asset size utilizing the property supply capabilities of Sekisui House Group and by implementing a growth strategy that fully applies the asset management know-how of Sekisui House Group and other property management companies.